Introduction

How to buy an S&P 500 index fund? The Standard & Poor's 500 Index is usually considered the most significant single gauge of large-cap U.S. stocks. It was the first market-cap weighted equity index in the United States when it was introduced in 1957. The index is the world's most widely used equity benchmark, with trillions of assets indexed to it. Historically, the index has included 500 of the largest publicly traded corporations in the United States, but this number is subject to change. Nearly 80% of the total U.S. market cap is tracked by the S&P 500. The stocks in the index have a median market capitalization of $27 billion and a maximum market capitalization of $2.2 trillion.

Advantages and Disadvantages of Investing in the S&P 500

If you're on the fence about investing in an index ETF or fund, think about how much time you'd save by not having to investigate individual stocks. Investing in an S&P 500 index fund or exchange-traded fund (ETF) may produce better returns than your time-consuming efforts would otherwise yield. Below, we've included some of the most popular advantages and cons of investing in this index.

Advantages

The following are some of the many advantages of investing in the S&P 500:

Interaction with Some of the World's Most Innovative Businesses

Companies like Apple, Amazon, Google, and Tesla, among the most innovative in the world, are just a few of the many that make up the S&P 500.

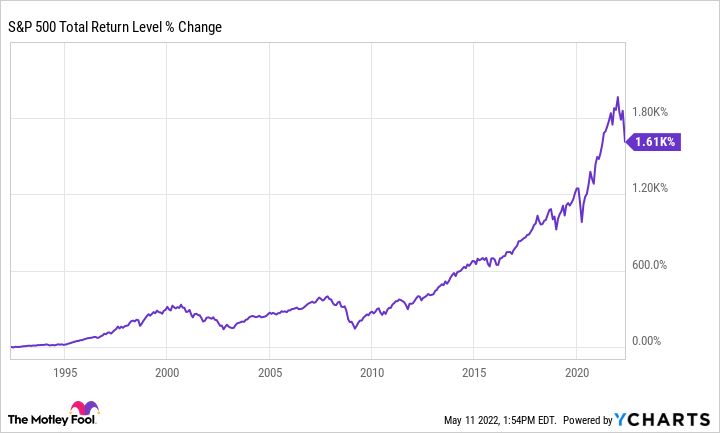

Consistent Long-Term Returns

Although yearly returns can be volatile, the S&P 500 has done well on average over the long term.

Intricate Analysis Not Required

You can invest in the S&P 500 without wasting time and energy researching and selecting individual stocks in a hopeless attempt to outperform the market by using an exchange-traded fund (ETF) or an index fund.

Can Serve as a Core Holding

Mutual funds and exchange-traded funds tracking the S&P 500 have high trading volumes and low bid-ask spreads. As a result, index funds and exchange-traded funds (ETFs) tracking the S&P 500 are well-suited for advanced techniques like covered calls and hedging and can serve as a solid foundation for any investment portfolio.

Disadvantages

Several of the most significant problems with the S&P 500 are listed below.

Large-Cap Companies Dominate the Index

A third of the stocks in the S&P 500 are owned by only ten of the largest corporations in the index. To put it another way, the S&P 500 index does not include any small- or mid-cap stocks, which may have more significant potential for growth than large-cap stocks.

Investing in the Index Requires Accepting Standard Equity Risks

As with any equity index, investing in the S&P 500 carries the usual market fluctuation risks and potential losses. In March 2020, for instance, the index dropped by about a third in value over a few weeks. Individuals just starting out in the investment market may find this kind of volatility too much.

Only Includes U.S. Companies

All companies outside the United States are left out of the S&P 500. This includes regions like Asia and Europe.

How To Buy the S&P 500?

Do you know how to buy the SP 500 index fund? Trying to buy a grocery list instead of groceries is a good analogy for investing in the S&P 500. A better strategy is to use index funds to gain exposure to the S&P 500. Like shopping baskets, they hold everything required to make an S&P meal. A market index can be replicated in the stock market through index funds. Through this method, investors' funds are pooled and used to buy a diversified set of securities.

Stocks from companies included in the Standard & Poor's 500 Index make up S&P 500 index funds. Investment professionals that oversee most index funds do not actively trade the fund's holdings. They are not aiming to outperform the index but rather to replicate its composition and history of returns—investors with a long-term, buy-and-hold horizon who prefer passive asset growth like index funds.

In addition to these factors, there is more to consider before investing in the S&P 500. Keep your primary investment allocation to the S&P 500. When constructing a diversified portfolio, it is essential to have both bonds and an S&P 500 index fund. To help you decide between two or three funds to include in your portfolio, we have compiled a list of the top total market bond index funds.

Conclusion

The question of how to buy fidelity SP 500 index fund is frequently asked. Warren Buffett has long advocated for investors to purchase S&P 500 index funds because of the potential benefits to their portfolios. A low-cost fund can be found, and a brokerage account can be opened with minimal effort, even for those without experience in the financial markets. You can expect stable results from either course of action or a combination of the two. You can save money on brokerage fees and commissions by opening an account well-suited to your trading needs. At that point, you'll be able to take advantage of the S&P 500's consistent long-term performance.