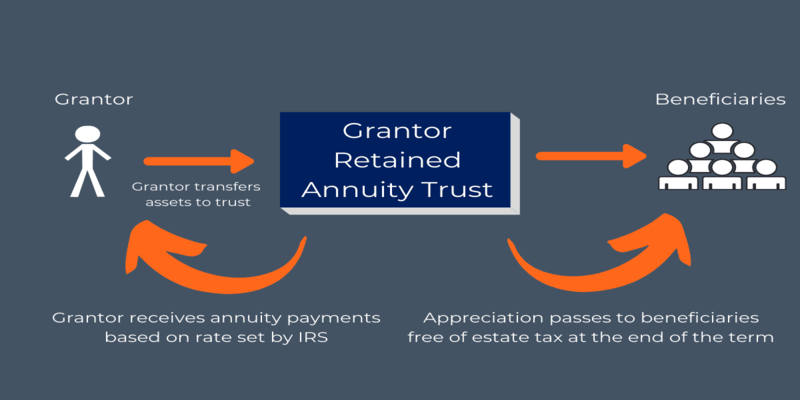

What are Annuity trusts with a grantor retainer? A An annuity trust in which the donor retains control (GRAT) is a legal tool used in estate planning to pass on assets to future generations while minimizing gift and estate taxes. It lets the grantor put assets, like stocks or real estate, into an irrevocable trust while keeping the right to receive a fixed annuity payment for a set number of years. At the end of the trust's term, any assets still in it are given to the beneficiaries, usually the grantor's children or grandchildren. The main benefit of a GRAT is that it can cut down on the amount of gift or estate taxes that need to be paid when assets are passed on. This is because the value of the gift is based on the present value of the annuity payments, not the full value of the assets that were put into the trust. If the value of the assets in the trust goes up more than the payments from the annuity.

Purpose of a GRAT

A GRAT is a way to pass on assets to future generations while keeping gift and estate taxes minimal. By giving assets to a GRAT, the grantor can freeze the value of the assets for tax purposes while still getting income from the assets during the trust term. If the value of the assets in the trust goes up more than the annuity payments, the extra value can be given to the beneficiaries without having to pay taxes on it.

Creating a GRAT

To set up a GRAT, the grantor must set up a trust that can't be changed and name the people who will get the assets at the end of the term. The grantor must also decide how long the trust will last and how much money will be paid each year.

Financing a GRAT

The grantor must put money into the GRAT with assets that will likely increase in value, like stocks or real estate. The grantor must also make sure that the value of the assets given to the GRAT is less than the present value of the annuity payments that will be made during the term of the trust. This is to keep from having to pay a gift tax.

Calculation of Annuity Payments

The value of the assets transferred to the trust, the length of the trust, and the applicable federal interest rate (AFR) when the GRAT is set up are used to determine how much the grantor will get in annuity payments over the life of the trust. The IRS sets the AFR based on the market interest rates at the time.

Term of the GRAT

The grantor sets the trust's term or the number of years that annuity payments will be made. The GRAT must last at least two years, but there is no limit on how long it can last. The grantor names the GRAT's beneficiaries, who will get any assets still in the trust at the end of the term. The grantor can name anyone or anything as the beneficiary, but usually, it's their children or grandchildren.

Tax Implications of a GRAT

One of the main tax benefits of a GRAT is that it lets the grantor give assets to future generations while minimizing gift and estate taxes. The present value of the annuity payments, not the full value of the assets given to the trust, determines how much the gift is worth. This can lead to a big drop in taxes on gifts and estates.

Conclusion

A An annuity trust in which the donor retains control (GRAT) is a tool for estate planning that lets a grantor give assets to future generations while keeping gift and estate taxes as low as possible. The grantor gives assets to the trust and gets payments called annuities as long as the trust is in place. Any assets still in the trust at the end of the term are given to the beneficiaries tax-free. GRATs have several benefits, such as lowering estate taxes, freezing the value of assets, and passing on wealth to future generations. But some things could go wrong, like the chance of losing money and the fact that you can only put so much into it. A GRAT is a tool for short-term estate planning. Before setting up a GRAT, the grantor should carefully think about their long-term goals. Overall, a GRAT can be a good way to pass on wealth to the next generation while paying the least taxes, but it is important to talk to a professional.